Last week we discussed the importance of Calculating the Pre-Deployment ROI of your ERP Investment, and also gave some insight into how to begin that process. For some of you, it may already be too late to calculate the pre-deployment ROI of your ERP solution. So this week, we’ll go over the steps necessary to calculate the post-deployment ROI of your ERP investment, and give you the core costs / benefits your company will need to consider when calculating your post-deployment ROI.

Calculating the actual ROI of any investment is never an easy task. Especially when it comes to ERP software. There are so many variables that need to be accounted for, and some of those variables, just cannot be measured (monetarily). So how can you get an ROI calculation that’s 100% accurate? The short answer: You don’t. But, following these three steps should help you get close enough to determine if your ERP implementation appears to have been a prudent investment.

Step 1: Calculate the Total Cost of Ownership (TCO)

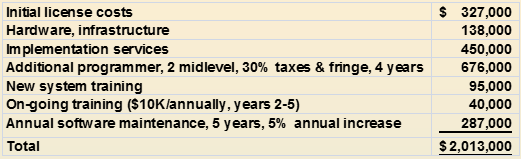

First, take a step back and look at what it cost you to implement the software. Keep In mind, you should plan to look at your investment over a 3-7 year time frame. Review initial expenditures and also quantify what it’s costing you to maintain / run your ERP solution on an annual basis. This will include all costs (both direct & indirect) incurred over a 3-7 year timeframe.

FACTORS TO CONSIDER:

| + Initial license costs + additional licenses | + Annual software maintenance |

| + Hardware | + Hosting costs (if applicable) |

| + System operation, personnel & Infrastructure | + ISV costs: Implementation, Training and Maintenance |

| + Helpdesk (if applicable) | + Additional personnel / consulting needed |

| + Training costs, initial and on-going | + Implementation services |

Incorporating the elements above, a sample TCO calculation might look something like this.

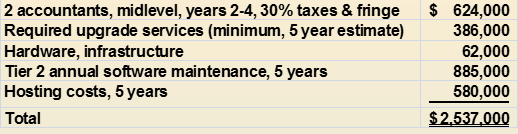

Step 2: Calculate costs eliminated from legacy system

Next, look at the costs that were eliminated due to the implementation of the new ERP solution. This step should be a good (or bad depending on the circumstances) indication as to how well the new ERP system is doing in terms of meeting your desired goals and objectives.

FACTOR TO CONSIDER:

| + License fees eliminated | + Planned system costs saved (to upgrade / maintain old system) |

| + Hardware costs reduced / eliminated | + Hosting costs eliminated (if applicable) |

| + Hours of labor eliminated | + Planned training costs eliminated (upgrade) |

| + Personnel eliminated | + Annual software maintenance eliminated |

| + Specialized helpdesk | + Training costs eliminated (on-going) |

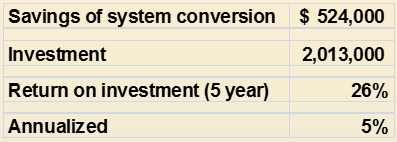

The savings of system conversion are (cost eliminated from legacy system) – (cost of new system). If the number is negative, a cost saving has resulted. If the number is positive, the new system has cost more than it’s saved. The example below shows a cost savings.

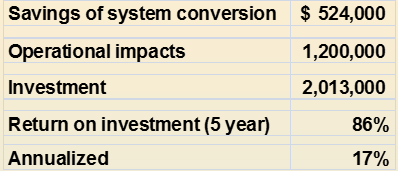

Step 3: Factor in Operational Impacts

This last step is probably the most difficult for companies because the benefits / cost savings can’t always be tracked monetarily (as mentioned above) or might be difficult to measure. Keep in mind, operational impacts should be wrapped into project objectives so that project success can be measured and tuned in areas where the project is falling short (allowing realization of full ROI potential).

To help your organization with this final step, reference the three sample calculations below.

Increased Manufacturing Capacity:

“The US production line is slowed or stopped for approximately thirty minutes three times daily (at the change of each shift) to enter machine data. Easing entry of this data (or capturing it electronically) could result in an increase in manufactured goods of approximately 2% (at a -0- labor increase).”

Calculation: 1 hour saved/24 hour production line = 4.2%. Note the conservatism in the estimate of savings.

Client manufactured goods = $108M. Impact = $2.2M

Out of stock reduction:

If out of stocks run 10% of all transactions and management estimates that half of those out of stocks could be converted to sales with better inventory integration and metrics, the expected increase to sales would be about 5% (if the new system fully realizes the potential).

Even a 50% realization of the potential capture would result in a 2.5% increase in sales, which would often fully fund a retail ERP project.

Sales = $160M. Impact = $4M

Reduction in discounting through better purchasing:

Discounting too deeply as a result of poor purchasing. How many items are sold at clearance for 50-75% off that should never have been purchased in the first place? Choosing styles contains some human judgment and art (rather than science), but a good system can increase the science side and improve the buyer’s chances of nailing down the art side.

If inventory is sold at 70% of suggested price, on average, and the new system could increase that to 75% by better anticipating demand flows and seasonality, a 5% increase in sales could be realized. Again, half the estimated benefit is used.

Sales = $80M. Impact = $2M

If your company is looking for a seasoned partner to help you calculate the post-deployment ROI of your ERP investment, feel free to contact us at [email protected]. And, to stay In The Know, connect with us via social media, or check out more posts on our blog.