Digital transformation is forcing a stark choice: adopt and adapt or become irrelevant. Traditional retailers have been slow to appreciate this, and as such have created a competitive disadvantage for themselves versus their natively digital competitors.

Product and Customer Data Management is one of the core elements in any Retail Digital Transformation that also includes, Brand Building and Brand Preservation, Growing and Protecting Marketshare, Customer Engagement, and Customer Interaction Technology.

Historically, retailing came to be characterized by three related shared values:

- One-to-one selling

- Loyalty of customers

- Shopping as a social exercise

Now, we are transitioning to the next phase: the age of digital retailing. This is characterized by the need to satisfy the customer’s expectation of personalized service, multiple access options, and a return to the social elements of shopping. These expectations require retailers deliver these experiences on a at scale as they transform their business model and strive to remain profitable. The key to achieving this starts with data, and the overlooked but fundamental process of data management.

Data: The lifeblood of the changing retail landscape

Successful Retailers are keenly aware that the rules have changed. The competitive environment is now in the virtual world as well rather than only the physical confines of a store. In the virtual world, data is critical. Think about it: Nothing can be represented, communicated or sold without data. There are no substitutions. The management of data becomes the determining factor for success or failure.

To digitally native retailers, the focus on data has been instinctive. Having no presence in the physical world, these retailers possess no execution asset other than data. This provides them an enormous operating advantage as all strategies, decisions, business processes and culture are driven by data.

Data is changing and what that means

When we think about data, intuitively we characterize it as structured and discrete items; for example, SKUs, sales, inventory records, customer records and other attributes of retailing in the transactional world. This understanding is incomplete. The digital revolution has brought a flood of additional data not considered before. Customers are now expressing interest in products shaped by the worlds of Pinterest, Facebook, Instagram and other social platforms — these are sources of decidedly unstructured data. Understanding the characteristics of each of these new data types and using them to create an integrated, timely and relevant consumer experience is at the heart of Digital Transformation.

Still on legacy systems, many retailers find themselves handcuffed to an outdated mindset of structured data. This places them at a strategic disadvantage. To make the transformation to the digital age, retailers must expand their understanding of the critical nature of structured data. The expanded universe of structured data is characterized as Master Data. The two primary types of Master Data are: Product Master Data and Consumer Master Data.

Product Master Data:

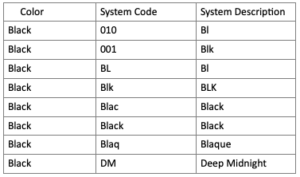

Retailers have never been good at collecting sufficient, consistent product data. The use of NRF color & size codes have helped, but there’s still very little dedication on the part of retailers to consistent, clean product data. To make matters worse, legacy merchandising systems are filled with years of old data that further muddies the water. The color table below is all too common an example.

This example, doubtless familiar to many, shows how something as simple as the color black can be misconstrued. The result begs this question: How can you possibly know how products are selling/trending if the foundational codes are inconsistent, diluted, or inaccurate? In response, the NRF introduced an additional level of color designation known as “Color Family”. This helps remediate the process in the example above, so that all the products could be identified as black. Taking advantage of color family functionality requires an additional data point to facilitate accurate capture of this data. Regrettably, few retailers are using this capability with enough consistency to add insight into customer demand.

Another example of Product Master Data is size codes. Trying to understand what is selling by size when there are 40 different codes representing the basic sizes is impossible. Even the best business intelligence systems are not equipped to overcome bad data; they were engineered create insights based on good quality data. For anyone who has implemented a new merchandising or business intelligence application, the process of cleaning up and correcting data is a huge undertaking and unnecessarily prolongs any project. Compounding the problem is that the data correction process is treated as a one-time event rather than a mission-critical activity of daily business operations.

Unfortunately, retailers have adjusted to working around poor, anemic product data.Size and color are just the bare minimum of product data. How are retailers managing data like fabric, fabrication, fit, fabric content or country of origin, to name a few in apparel? The same goes for accessories, shoes, hardgoods, electronics, jewelry, furniture, even household products.

All this data has been used only for product identification, rather than to enhance the customer experience. Very few organizations are focused on this level of detail; in fact, most became accustomed to muddling through with patchy data on size, color and few other product attributes necessary to truly understand consumer preferences.

Most retailers still believe that digital transformation is the responsibility of only the technical team. Unfortunately, because store-native retailers have suffered with this situation for so long, they have adjusted to working around poor and anemic product data. Typically, assistant buyers and merchandise planners have become quite adept at the weekly download and manipulation of data into reports. The reports are only as good as the quality of data that they are based on. For them, the easy fix seems to be the installation of a business intelligence (BI) application. The flaw in this strategy is it ignores the fact that the information derived from these systems will never be of value if the underlying data tied to the item/article master is incomplete or inaccurate, a condition has been accepted for years. This complacency manifests as a competitive disadvantage when compared to digitally native retailers.

Customer Master Data:

The advent of the Universal Product Code (UPC) was a significant enabler for the industry to create a standard methodology for identifying products. Unfortunately, a similar identifier for the consumer does not exist. The consumer identifier equivalent to the UPC is the concept of the Golden Customer Record (GCR). This identifier must be unique for each consumer, combining traditional retailer interactions with new methods of associating data across social media and other platforms.

The consumer identifier equivalent to the UPC is the concept of the Golden Customer Record (GCR).Many CEOs, CMOs and CIOs believe that their existing systems provide a 360-degree view of the customer. However, even a cursory investigation reveals this is typically not the case. Most store-based retailers have multiple repositories of customer data. First, most have a customer database embedded within their POS or core merchandising system. Second, their loyalty application holds a great deal of customer activity, and third, they have customer data in their webstore application. Many marketing teams are tasked with “running reports” to understand customers’ activities across all these access points. However, developing usable insights is impossible if the same customer has multiple records in any of these siloed databases, to say nothing of the requirement to combine and establish a single customer identity across all databases. Clean, consistent, consumer data irrespective of IT’s storage strategies is the only way to have a 360-degree of the customer and with it any hopes of recognizing their true lifetime value.

Digitally native retailers have not had this burden. Their webstore infrastructure is the primary conduit through which they reach, understand and interact with their consumers. If a consumer buys a product on the website, by default, their name, postal address, and email are collected. These data elements are the foundation of the GCR.

For many retailers, a single customer may have multiple unique customer records in the customer database. Consider this possible scenario: Customer One has 10 individual customer records with a retailer. Customer Two has a single customer record (GCR). Customer One buys the same white shirt (one on each of his customer identities). Customer Two buys the same 10 shirts all on his single customer record (GCR). From this example, it would be easy to determine that Customer Two is a good customer with specific preferences that the retailer could market similar or complementary products to. Based on Customer One’s data, we know NOTHING about Customer One. Period. This simple example illustrates the critical need to master Customer Master Data.

Harnessing the power of unstructured data

As businesspeople and consumers ourselves, we are aware that there is a whole new world of content affecting our everyday life and our interests in products and services. Digital images and content from external data sources like Instagram, TikTok, Facebook, Pinterest and YouTube, as well as customer reviews and the activity of influencers, are impacting demand. The challenge before retailers: How can this type of data be captured and utilized to drive business?

All that we have discussed regarding structured data is not the end point for retailing’s transformative challenge, but rather just the start. Too few retailers have mastered their structured data. Until retailers accomplish their will be unable meet the fundamental shifts in strategies and operations necessary to reshape operational execution. Once accomplished, they will be ready to undertake the most important transformative activity: Building the integration between structured data with the unstructured data of their consumers.

Generally, there are two types of unstructured data: Confined data and unconfined data.

Confined Data: Confined data are data elements that capture behaviors of what a consumer may search for, what he or she may sort on, compare, view, drill down on, or even spend the most time viewing on a website. This new information must then be associated to whether a sale is eventually consummated or abandoned. The activity of consumers as they move around a given website may seem random, but is in fact a reflection of their purchase journey. This activity is easily captured because it is confined. Because the activity occurs within the retailer’s domain, it can be collected and utilized to understand how consumers are shopping.

Understanding how consumers search, view and compare products on their journey to purchase (or not) provides a wealth of intelligence to which the retailer can then respond. Within confined data, the source of the original search can be captured. If, for example, a search started on Google or Facebook, and is then directed into a company’s webstore, the source of the original search will be captured, providing insight as to what influenced the consumer on their journey to purchase.

Unconfined Data:

Unconfined data is less intuitive because it exists outside the construct of the company’s technology domain. This presents retailers with a new challenge. The sources of this type of data are almost unlimited. This new data varies in content type, frequency, and complexity. These can take the form of images from fashion magazines or social media posts to unique cellphone device pings that allow a retailer to know when a consumer enters a store. The challenge is devising a methodology to capture and utilize it.

Retailers are operating on more of a seasonless or fast fashion model, upending decades of old ways of doing business.Sources of unconfined data will become more prolific and powerful in the coming years. Capitalizing on these sources will never be realized by the retailer unless they bring this additional data into their interactions with each customer. This can never occur if the retailer has not been rigorous in collecting basic structured data.

The goal is to engage in some dialog with the consumer in the moment whether the interaction is virtual or physical. But again, we stress that without dedication to a data management program that assures complete, accurate and timely information, this connection will never be made. Without identifying the customer with a single GCR, it will be impossible to determine their lifetime value.

Survival depends on change: Change depends on data

The world is changing at an accelerating rate compressing business cycles. Many merchants grew up with established seasons and sell-through cycles. Today, retailers are operating on more of a seasonless or fast fashion model, upending decades of old ways of doing business. This is made necessary by the need to keep up with the customer and their ever-changing interests driven by the stimulus of the digital world.

The challenge is in delivering a flow of new products to keep the customer engaged. Retailers must anticipate customers’ needs and set the trends, not get caught reacting to them. This requires timely and accurate data because the margin for error has been significantly reduced, thus eliminating the possibility to recoup or capture a missed opportunity.

The need to understand customer’s preferences requires a new level of timeliness and degree of specificity. Integrity of master data (product AND consumer master data) is critical to the creation of timely and accurate information to keep up with the new decision-making cycles. Historically, the business teams have relegated the responsibility of data quality and integrity to the IT organization. For a time, there was no penalty to this.

This history has made the adoption of technology leadership more challenging for retailers, wholesalers and brands have been reluctant to become technology leaders. Historically, the industry is chronically under-invested in technology. Now many find themselves lacking the necessary technology infrastructure to compete. Additionally, they have been slow to adopt operational changes necessary to compete. In the past, improvements to business processes have been driven by the purchase and implementation of technology, not the customer’s expectations.

Final Thoughts:

The needs of the customer must transcend the needs and goals of any individual or group within the organization. This is achieved by starting with the customer and determining what drives their purchase decisions. Working from the customer backwards is the only way we will be able to take the required business information and break it down to understand the required data elements. This knowledge provides the roadmap to then reverse engineer the necessary applications and business processes to maximize the lifetime value of every customer.

What’s Next?

To succeed in this changing landscape, store-native retailers will need to abandon their legacy habits and start acting like their digital-native competitors. We’ve created a guide for having crucial discussions about Digital Transformation with leadership, including a big picture perspective that outlines why these projects are about survival, not just technology. And a visual roadmap to help guide these conversations, outline the current state of retail and tips on succeeding in this new environment. You can download this guide in a whitepaper we call, “Retail Transformation Imperatives: 5 Imperatives for Retailers, Wholesalers and Brands.” A how to manual for navigating the ever-evolving retail world, and a blueprint for success in the new era of commerce.